UniswapX: The Birth of a Game-Changing DEX Protocol

Uniswap, the leading decentralized exchange (DEX) protocol, has announced the launch of UniswapX, a non-custodial, Dutch auction-based protocol that promises to revolutionize on-chain trading. This innovative solution aims to provide users with a centralized exchange (CEX)-like experience while maintaining the benefits of decentralization. Let's dive into the details of this exciting development and what it means for the future of decentralized finance (DeFi).

Introduction to UniswapX

On July 17, 2023, Uniswap unveiled its plans to launch UniswapX, a protocol designed to enhance the on-chain trading experience. The primary goals of UniswapX include:

- Aggregating liquidity

- Preventing Miner Extractable Value (MEV) attacks

- Enabling gas-free transactions

These features aim to bring the user experience of decentralized exchanges closer to that of centralized exchanges, addressing some of the key challenges faced by DEX users.

Following the announcement, Uniswap Labs quickly moved into the product development phase. In September of the same year, they launched a bug bounty program covering contracts such as Reuter, V3, and UniswapX, with rewards of up to $2.25 million.

Key Features and Benefits

Limit Orders

In February 2024, Uniswap Labs introduced a limit order feature supported by UniswapX. This functionality leverages both on-chain and off-chain liquidity, allowing users to:

- Place orders without paying gas fees

- Set orders for any swap size without minimum requirements

The limit order system works as follows:

- Users specify their desired price for a token swap.

- If the market reaches the specified price and a UniswapX "filler" accepts the swap request, the order is automatically executed without any gas fees.

- If the order is not filled within the user-specified timeframe, it expires without incurring any costs.

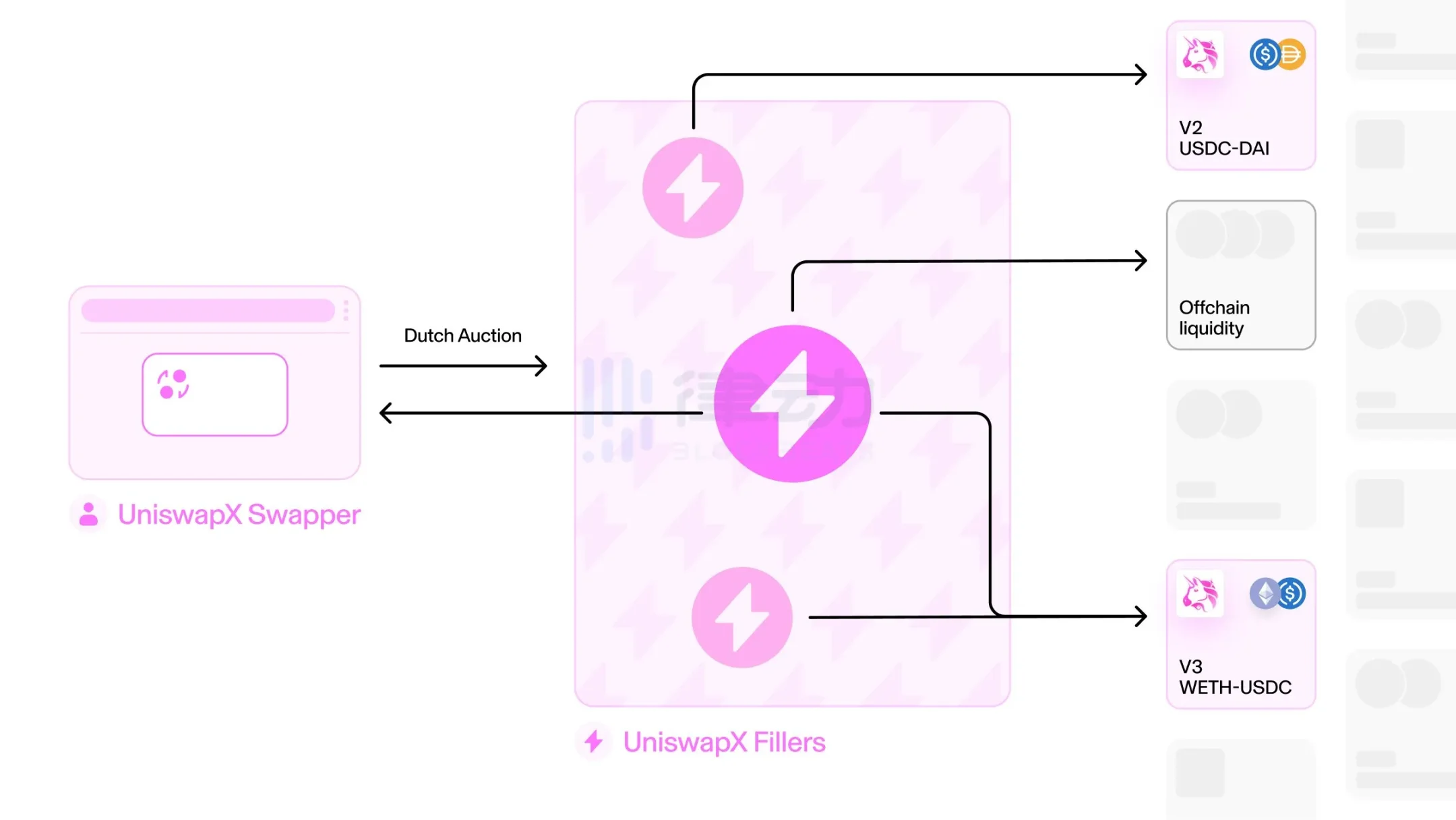

Open Network of Fillers

UniswapX outsources routing complexity to an open network of third-party fillers. These fillers compete to fulfill trades using:

- On-chain liquidity (e.g., Uniswap v2 or v3)

- Their own private inventory

Importantly, anyone can become a third-party filler for UniswapX trades, promoting a more decentralized and competitive ecosystem.

Current Limitations and User Experience

As of now, UniswapX is only available on the Ethereum mainnet through the Uniswap web application. However, there are plans to expand its functionality to other products, such as the Uniswap wallet, in the future.

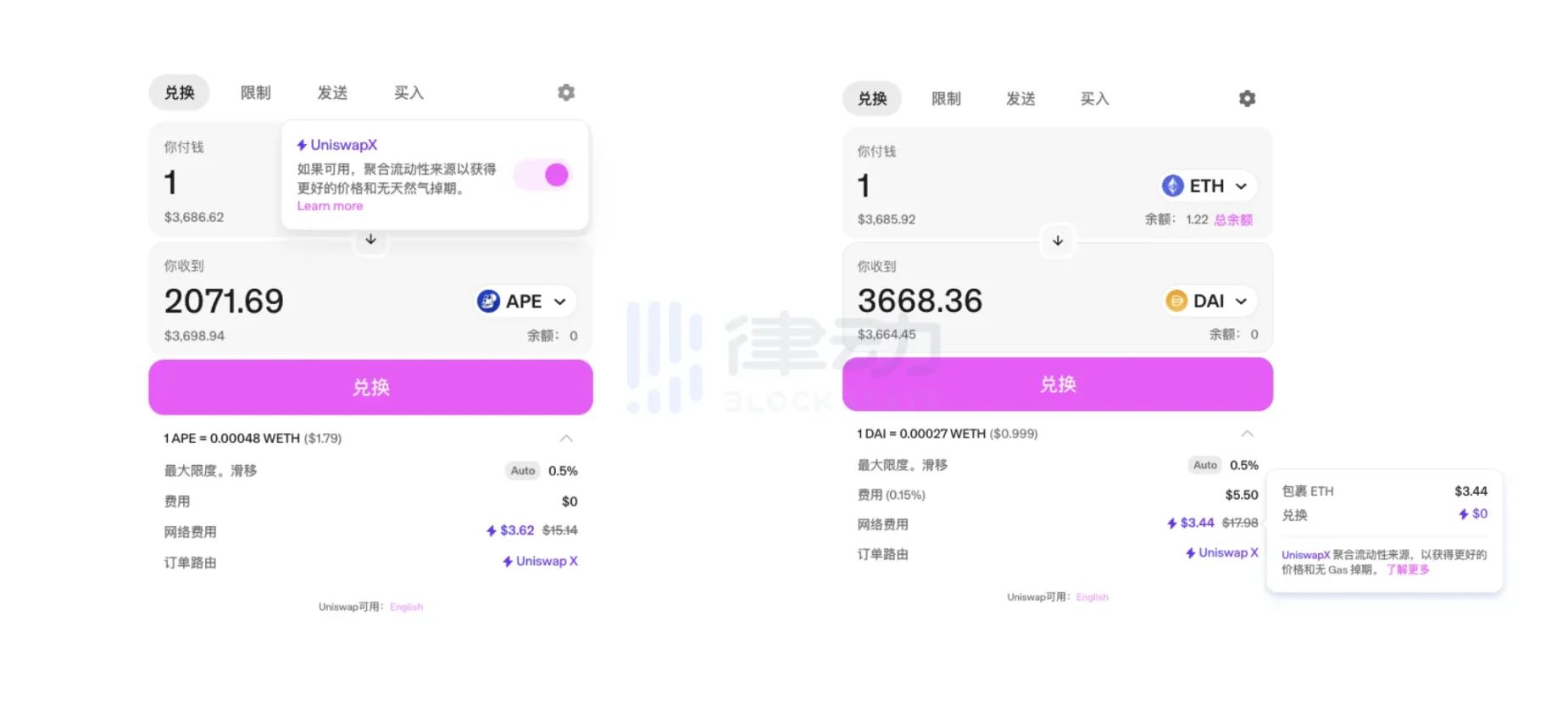

To use UniswapX, users simply need to enable the "UniswapX" switch in the settings menu located in the top right corner of the Uniswap web application.

Limited Gas-Free Token Support

After testing the product, BlockBeats found that only a limited number of tokens currently support gas-free transactions through UniswapX routing. These include:

- DAI

- UNI

- 1INCH

- APE

However, popular tokens like AAVE, ARB, and USDT often cannot utilize UniswapX routing.

This limitation is due to Uniswap's automatic routing system, which selects the best trading path based on optimal transaction fees. If the slippage for V2 or V3 trades is lower than UniswapX, Uniswap automatically redirects users to these alternative trading paths.

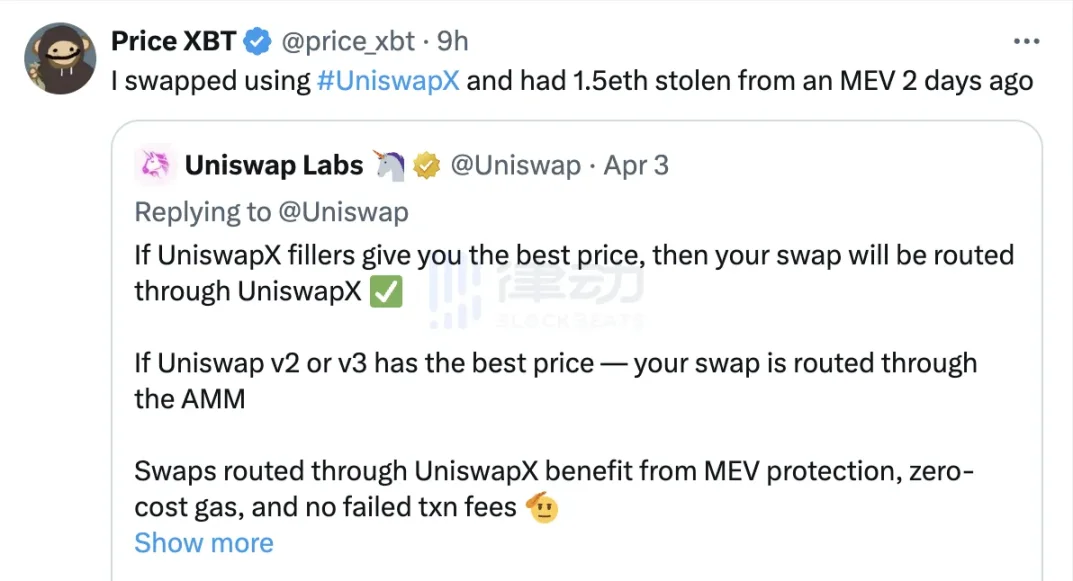

Early-Stage Challenges

As UniswapX is still in its early stages, market discussion and usage intensity remain relatively low. Some users have reported experiencing MEV attacks even when using UniswapX, although these claims have not been independently verified.

The Future of UniswapX and DEX Trading

Despite its current limitations, UniswapX represents a significant step forward in the DeFi space. As one of the most anticipated innovative products in the field, it continues to push the boundaries of what's possible in decentralized trading.

As more market participants and users engage with UniswapX, we can expect:

- Expanded token pair coverage

- Improved user experience

- Enhanced liquidity aggregation

- More robust MEV protection

UniswapX's arrival marks another milestone in the ongoing effort to bridge the gap between DEX and CEX trading experiences. While challenges remain, the potential for UniswapX to reshape the DeFi landscape is undeniable.

As the protocol matures and gains wider adoption, it will be fascinating to see how UniswapX evolves and potentially sets new standards for decentralized trading platforms.

Keywords for SEO: UniswapX, Uniswap, decentralized exchange, DEX, DeFi, gas-free transactions, limit orders, MEV protection, liquidity aggregation, on-chain trading, ethereum, crypto trading